Creative Real Estate Investment | You Need To Know

Summary: Who knows how many ways there are to invest creatively in real estate, but there is one key to

Types of mortgages available in Canada

When it comes to buying a home, one of the most important decisions you will make is how to finance it. In Canada, there are several different types of mortgages available, each with its own unique features and terms. Understanding the different options can help you make an informed decision and find the best mortgage for your needs.

Fixed-rate mortgages: A fixed-rate mortgage is the most common type of mortgage in Canada. With a fixed-rate mortgage, the interest rate remains the same for the entire term of the mortgage, which is typically 25 years. This means that your monthly mortgage payments will remain the same, even if interest rates rise. The main advantage of a fixed-rate mortgage is predictability, as you know what your payments will be for the entire term of the mortgage. This makes budgeting and planning easier as you know exactly what your mortgage payments will be. However, if interest rates drop, you will not benefit from the lower rate and may end up paying more than you would with an adjustable-rate mortgage.

Adjustable-rate mortgages (ARM): An adjustable-rate mortgage (ARM) has an interest rate that can change over time, a lower interest rate than a fixed-rate mortgage for the initial period, usually 1-5 years. The interest rate is typically based on a benchmark, such as the prime rate, and is adjusted periodically, usually annually. This can be beneficial if interest rates are expected to drop, but can also be risky as the interest rate can increase, resulting in higher monthly mortgage payments. The advantage of an ARM is that the interest rate is often lower than a fixed-rate mortgage, at least for the initial period of the mortgage. However, the downside is that your monthly payments can increase if interest rates rise.

Government-insured mortgages: Government-insured mortgages are backed by the federal government, which means that they have more lenient qualifying criteria than conventional mortgages. The most common government-insured mortgages in Canada are the Canada Mortgage and Housing Corporation (CMHC) insured mortgages. These mortgages are available to first-time home buyers and buyers with a down payment of less than 20%. The main advantage of a government-insured mortgage is that you can qualify with a lower down payment, but the disadvantage is that you will have to pay a mortgage insurance premium.

Flexible mortgages: Flexible mortgages are a type of mortgage that allows you to vary your payments, make extra payments, or even skip payments without penalty. This type of mortgage is useful for those who have a variable income or those who want the flexibility to pay more or less depending on their financial situation.

Cash-back mortgages: Cash-back mortgages are a type of mortgage that provides a lump sum of cash at the time of closing. This cash can be used for various purposes, such as home renovations, buying furniture, or paying off other debts. The main advantage of a cash-back mortgage is that it provides you with extra cash to use towards home-related expenses, but the disadvantage is that you will typically pay a higher interest rate which can add to the overall cost of the mortgage.

Combination mortgages: A combination mortgage, also known as a blended mortgage, is a type of mortgage that combines two or more of the above types of mortgages in Canada. For example, you might have a fixed-rate mortgage for the first five years and then switch to an adjustable-rate mortgage for the remaining term. This type of mortgage can be useful for those who want the predictability of a fixed-rate mortgage, but also want flexibility However, it can be more complex and may not be suitable for those who prefer a simple and straightforward mortgage.

It’s important to keep in mind that the type of mortgage you choose will depend on your personal circumstances, financial goals, and current market conditions. It’s recommended to speak with a mortgage broker or a financial advisor to help you understand your options and choose the best type of mortgage for you. Read More: Understanding The Mortgage Market in Canada.

Summary: Who knows how many ways there are to invest creatively in real estate, but there is one key to

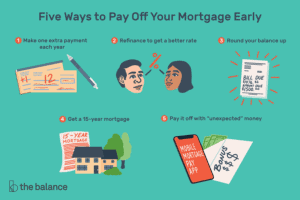

Pros and Cons of Extra Mortgage Payments: Purchasing a home is one of the largest financial investments you will ever

Types of mortgages available in Canada When it comes to buying a home, one of the most important decisions you

Copyright © AVN foundation 2021. All rights reserved. Developed by AVN Foundation