Contracts When Selling Your Home Without An Agent

Summary: Contracts When Selling Your Home Without An AgentA recent survey revealed that approximately 30 percent of homeowners intend to

Credit denial occurs when a financial institution, such as a bank or credit card company, denies your application for credit or loan due to your creditworthiness. Creditworthiness is determined by your credit score, which is a numerical representation of your credit history, and other factors such as income, employment status, and debt-to-income ratio. If you have been denied credit, there are several steps you can take to understand why and improve your chances of approval in the future.

Why Were You Denied Credit?

The first step to understanding why you were denied credit is to review the notification letter or email sent by the financial institution. The letter will provide the reasons for the denial and outline your rights to receive a free copy of your credit report within 60 days. You should review your credit report for any errors or inaccuracies, such as outdated information, duplicate accounts, or fraudulent activity. If you find any errors, you should report them to the credit bureau(s) in writing and provide evidence to support your claim.

Common reasons for credit denial include a low credit score, a high debt-to-income ratio, insufficient credit history, or negative items on your credit report such as missed payments, defaults, or bankruptcies. Financial institutions use credit scores to assess the likelihood that you will repay the credit or loan. The higher your credit score, the lower the risk to the lender and the better your chances of approval.

What Can You Do About Credit Denial?

If you have been denied credit, there are several steps you can take to improve your creditworthiness and increase your chances of approval in the future:

Review your credit report: As mentioned earlier, review your credit report for errors or inaccuracies and report them to the credit bureau(s) in writing. You should also review your credit report regularly to monitor your creditworthiness and detect any fraudulent activity.

Improve your credit score: Your credit score is a critical factor in determining your creditworthiness. To improve your credit score, pay your bills on time, keep your credit card balances low, and limit new credit inquiries. You should also maintain a mix of credit accounts, such as credit cards, loans, and mortgages, to show that you can manage different types of credit responsibly.

Reduce your debt-to-income ratio: Your debt-to-income ratio is the percentage of your monthly income that goes towards paying off debt. A high debt-to-income ratio can indicate that you have too much debt and may have difficulty repaying new credit. To reduce your debt-to-income ratio, consider paying off or consolidating your debt, increasing your income, or reducing your expenses.

Build your credit history: If you have a limited credit history, consider opening a secured credit card, which requires a security deposit, or becoming an authorized user on someone else’s credit card. These actions can help you build a positive credit history and improve your creditworthiness over time.

Apply for credit wisely: Before applying for credit, research the financial institution’s credit requirements and rates to ensure that you meet the criteria. Applying for multiple credit cards or loans within a short period can also lower your credit score and hurt your chances of approval.

Consider alternative credit options: If you have been denied traditional credit, consider alternative credit options such as secured loans, credit builder loans, or peer-to-peer lending platforms. These options may have lower credit requirements and can help you build your credit history.

Conclusion

Credit denial can be a frustrating and disappointing experience, but it is not the end of the road. By understanding the reasons for credit denial and taking steps to improve your creditworthiness, you can increase your chances of approval and achieve your financial goals. Review your credit report regularly, improve your credit score, reduce your debt-to-income ratio, build your credit history, apply for

Summary: Contracts When Selling Your Home Without An AgentA recent survey revealed that approximately 30 percent of homeowners intend to

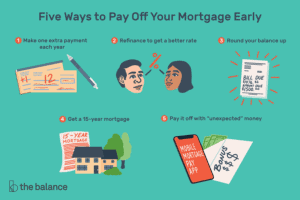

Pros and Cons of Extra Mortgage Payments: Purchasing a home is one of the largest financial investments you will ever

There are several different ways I built credibility. First of all, like it or not, people make value judgements about

Copyright © AVN foundation 2021. All rights reserved. Developed by AVN Foundation